The industrial zone of El Bajio has a huge amount of space available for operational centers, especially ones aimed at automotive manufacturing and the data center construction. This sets up a great contribution to the growth of several sectors.This is why El Bajio has one of the highest levels of Foreign Direct Investment (FDI). According to the Secretariat of Economy, the investment amounted to US$1,664 million1 this year; 38% went to Guanajuato, 30% to Queretaro, and 16% to San Luis Potosi and Aguascalientes.

As stated by the “Bajio Industrial 2Q 2022” (CBRE) report, in the first half of 2022, the Bajio region accounted for 2.7 million sqft in the construction of industrial space, demonstrating how important it is to the country’s economic growth.

The report also highlighted the fact that in the region’s states, Class A industrial inventory increased by 2.2%, reaching 140 million sqft, and the vacancy rate decreased by 4.2%, its lowest level since 2018.

That, along with the industry’s performance, foretells the expansion of some automotive companies, the restart of speculative projects, and an increase in sales based on these factors.

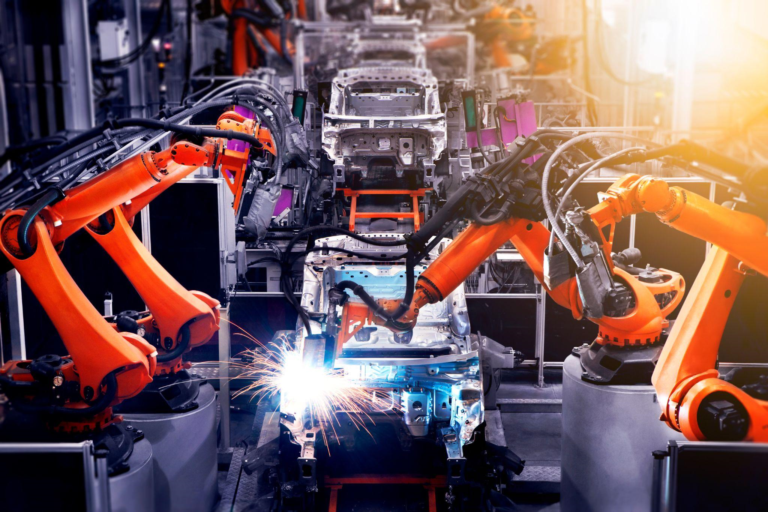

Bajio region: the leader in automotive production

Currently, El Bajio is recognized as the number one region for automotive production2. The industry gained this achievement after facing huge challenges in the last few years.

The Administrative Record of the Light Vehicle Automotive Industry (RAIAVL by its acronym in Spanish) stated that General Motors Company (Silao, Guanajuato complex) was one of the largest automotive manufacturers in Mexico, with 169,044 units. Close behind are Honda (68,562), Mazda (62,488), and Toyota (59,355).

In the San Luis Potosi industrial area, General Motors produced 102,768 vehicles, and BMW 29,118. Meanwhile, Aguascalientes experienced highly competitive production levels with 114,391 units manufactured by Nissan A1, 56,232 by Nissan A2, and 62,007 by COMPAS (Infiniti/Mercedes-Benz).

All in all, the Bajio region produced 723,965 units, outperforming the northern and central regions, which respectively produced 598,846 and 338,535.

Strategic location for Build to Suit (BTS) projects and data centers in Mexico

Only surpassed by Monterrey and Saltillo markets, the Bajio region has the largest availability of industrial space.

Out of these projects, the BTS (Build to Suit) occupied 60% of the 2.7 million sqft of industrial construction in the region.

Furthermore, investment in data centers appears to be booming in the area with projects such as Falcon by Layer 93, one of the biggest data centers in El Bajio. It’s a project with enough funding to start running.At Advance Real Estate, we provide Class A industrial space and land for Build to Suit projects within our industrial parks, in accordance with the specific needs of each company.

Information Source: